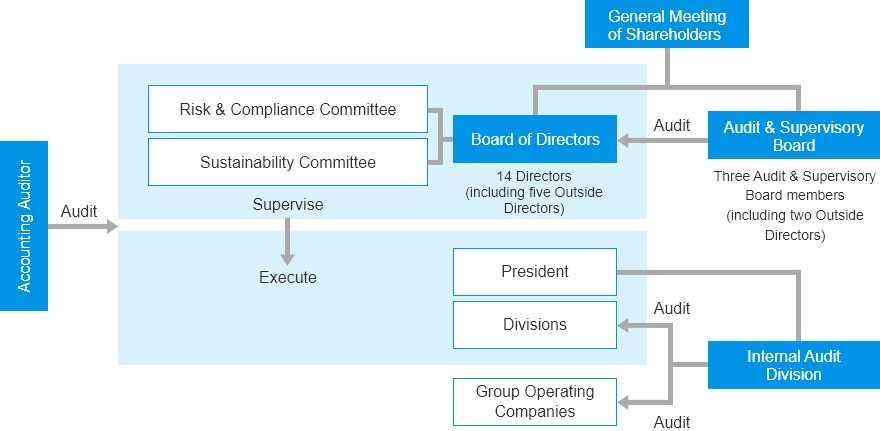

Risk Management System

The VITAL KSK Group has formulated risk management regulations and implements risk management with the aims of prevention, preventing the occurrence of management risks themselves, and minimizing impact by understanding the situation and responding promptly and appropriately when risks occur. To ensure thorough risk management and compliance throughout the Group, the Company has established a Risk and Compliance Committee, which meets twice a year in principle. Decisions and reports by the Committee are distributed to each operating company and throughout the Group by the chairpersons of similar committees at operating companies. The Sustainability Committee formulates strategies, sets targets, and manages risks and opportunities relating to sustainability, including those relating to climate change, and reports the details to the Board of Directors.

Risk Management System Diagram

Information Security

Approach to Information Security

The Group engages in businesses related to life and maintaining health, and is often exposed to sensitive information in the medical field. Society requires the Group to exercise careful consideration and handling of such information.

We recognize that the safe and correct handling of information and the stable operation of systems are indispensable to providing higher quality services without compromising corporate value, and to ensure the continuity of our business.

Formulating an Information Security Policy

We have formulated the VITAL KSK Holdings Information Security Policy to further enhance safety and security and help Group employees to recognize the importance of information security. The Information Security Policy is a comprehensive, specific and systematic policy designed to protect information assets owned by the organization from threats. It outlines the Group’s basic approach to information security and policies on systems, organization and operation to ensure information security.

In accordance with the VITAL KSK Holdings Information Security Policy, the Group fulfills its social responsibilities by formulating internal rules and implementation standards in line with specific organizational units, data and information assets.

Major Business Risks and the Group’s Response