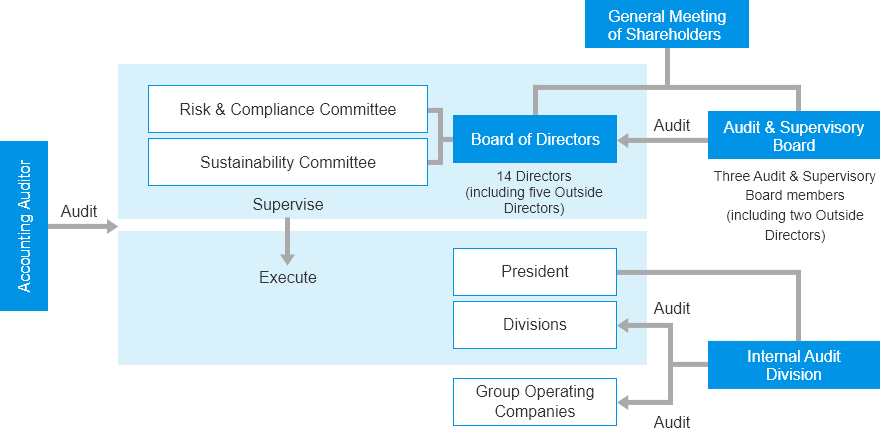

Corporate Governance Structure

With the approval at the 14th Ordinary General Meeting of Shareholders held on June 29, 2023, VITAL KSK Holdings transitioned to a Company with Audit & Supervisory Committee model.

The Board of Directors consists of fourteen members, two of whom are women. In addition, five are outside directors with extensive experience and knowledge and deep insights into corporate governance from their perspectives as a business manager, academic experts, lawyers, and certified public accountants. By receiving highly meaningful recommendations and advice on the management of the Group, we ensure transparency and soundness of management, and have established a system to monitor and supervise the execution of duties by directors.

We have also held Advisory Meetings to deliberate and advise the Board of Directors on matters such as the nomination and remuneration of directors, as well as overall corporate governance.

The Audit & Supervisory Committee consists of three members, two of whom are outside directors who perform accurate auditing and supervision functions from their respective professional standpoints and perspectives as a lawyer and certified public accountants. As of the July 2023 meeting of the Board of Directors, we have introduced a discussion time on various management issues to stimulate discussions at Board meetings. In the future we will incorporate external evaluations into our evaluations of the effectiveness of the Board of Directors, and we will continue working to enhance our corporate governance system.

Corporate Governance Chart

Board of Directors

The VITAL KSK Holdings Board of Directors is responsible for the Group’s executive management functions. It is composed of up to 12 directors as stipulated in the Articles of Incorporation (excluding directors who are Audit & Supervisory Committee members) and no more than five directors who are Audit & Supervisory Committee members. Membership is essentially determined to give the Company the effective management system required of a holding company, the appropriate number of members required to ensure substantive discussions at Board of Directors meetings, and the abilities, knowledge, and experience required for the actualization of the Group’s corporate philosophy and management strategy. As a general rule, meetings of the Board of Directors are held once a month, and separate meetings are held as necessary to decide upon matters dictated by laws and/or regulations and important matters relating to management, and to supervise the state of execution of business.

Key matters discussed in fiscal 2023

- Appointment of representative directors and directors with titles

- Determination of remuneration for directors

- Approval of conflicts of interest and competing transactions by directors

- Discussions and policy decisions to implement management with an awareness of cost of capital and stock price

- Formulation of management plans

- Investment decisions for growth

- Approval of financial statements

- Dividend Payments

- Convocation of General Meeting of Shareholders

- Report state of execution of duties

Nomination and Compensation Advisory Committee

In July 2024, we established the voluntary Nomination & Compensation Advisory Committee, as an independent advisory committee to replace the Advisory Meeting. Matters concerning the appointment of director candidates and compensation for directors are determined by consultation with the Committee (consisting of five outside directors and three representative voters) to obtain appropriate advice before resolution by the Board of Directors.

Key matters discussed at Advisory Meetings in fiscal 2023

- Policies and procedures for the appointment and dismissal of senior management and directors

- Performance assessment and personnel management for senior management

- Policies and procedures for the compensation of senior management

- Assessment and analysis of the effectiveness of the Board of Directors

- Policy on corporate governance structure including the Company’s institutional design

Attendance (FY2023)

Audit & Supervisory Committee

Until the Group’s transition to a Company with Audit & Supervisory Committee system in June 2023, the Audit & Supervisory Board met mainly to verify quarterly and yearly financial results, receive reports from the Internal Audit Division on all aspects of the execution of business, and verify and evaluate that the execution of business throughout the Group was being conducted appropriately and efficiently, based on the annual audit plan.

Even since the transition to a Company with an Audit & Supervisory Committee system, we ensure transparency and soundness of management through auditing and supervision by the appropriate operation of the Audit & Supervisory Committee. To ensure thorough compliance with laws and regulations, the Group has also established a Compliance Statement, as a code of conduct for all officers and employees.

Key matters shared and discussed in fiscal 2023

- Audit policies, audit plans, and division of duties

- Evaluation of accounting auditor

- Review of Audit & Supervisory Committee audit standards

- Status of audits at each Group company

Overview of activities

| Director |

- Attendance at meetings of the Board of Directors

- Meetings with the representative director

|

| Execution of business |

- Viewing and checking important documents

|

| Internal audits |

- Audit plans and reports of findings from auditing divisions

- Meetings with internal control divisions

|

| Accounting audits |

- Three-party audit meetings

- Explanation of audit plans, quarterly review reports, and audit result reports from the accounting auditor

- Accounting auditor evaluations

|

Attendance at meetings of the Audit & Supervisory Committee (FY2023)

Evaluation of the effectiveness of the Board of Directors

To verify that the functions expected of the Board of Directors are being fulfilled appropriately and improve upon them, we conduct an annual evaluation of the Board’s effectiveness.

In addition to this, to verify the effectiveness of the system in a neutral and objective manner, we request an evaluation from a third-party assessment body at regular intervals (around once every three years).

The analysis and evaluation of the effectiveness of meetings of the Board of Directors held from April 2023 through March 2024 was conducted by a third-party assessment body.

A questionnaire-based survey of all directors was conducted regarding the state of execution and supervision, and the Board’s effectiveness was evaluated and analyzed based on the results.

The main issues identified in the results of this evaluation and measures taken to address them were as follows.

In addition, the following points were found to have improved in comparison with the time of the previous effectiveness evaluation conducted in April 2023.