The Medium-Term Management Plan 2027 - Move on to the Next Stage -

* Figures for “FY2024 Forecast” announced on April 17, 2025 have been replaced with actual figures (as of May 14, 2025).

Medium-Term Vision

Business Model Innovation with an eye to the Next Generation - Phase 2 -

The Company plans to fully incorporate a Group management approach that is conscious of the cost of capital, as befits a company listed on the TSE Prime market, and in order to achieve sustainable growth and medium to-long term enhancement of corporate value as a Group, the Company plans to strengthen the profitability of existing businesses and review its business portfolio, while also making aggressive investment in growth. Through such measures, the Company intends to implement business model innovation that is a step up from the previous medium-term management plan.

This Mid-Term Management Plan 2027 sets forth three Managerial goals and three priority measures to achieve these goals under the Mid-Term Vision “Business Model Innovation with an eye to the Next Generation - Phase 2”.

Our Vision

Our Purpose and Long-Term Vision 2035

We aim to implement stable and profitable management as an indispensable presence in regional and community healthcare.

Three Managerial Goals

We are committed to achieving them in the three-year period ending March 31, 2028.

Three Priority Measures

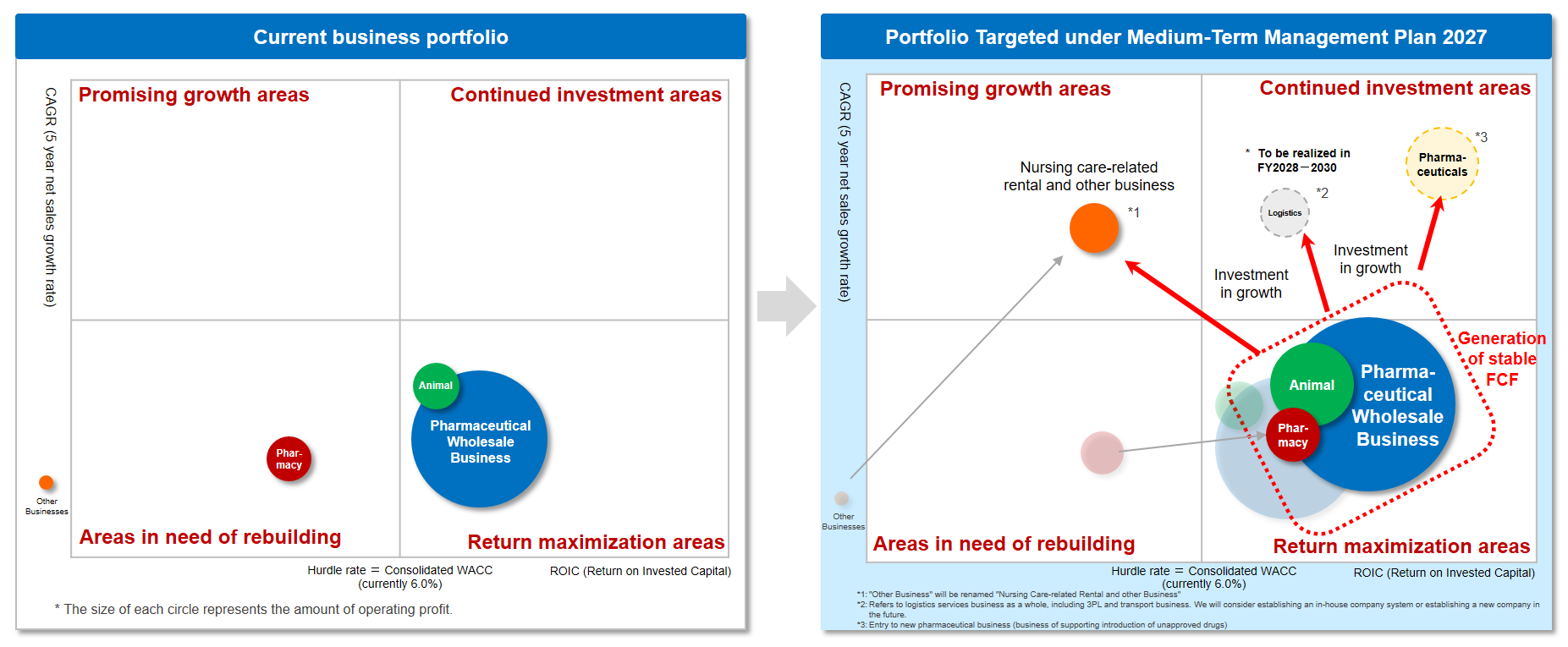

Business portfolio management

Business portfolio management

Business Portfolio Basic Policy:

・In existing business, perform evaluation and monitoring each fiscal year based on

ROIC (Return On Invested Capital) and CAGR (5 year net sales compound annual growth rate)

・For hurdle rate, use consolidated WACC (Weighted Average Cost of Capital).

(Currently, WACC is estimated at around 6.0% (average for past three fiscal years).)

・For any unprofitable, low growth businesses positioned as "areas in need of rebuilding",

formulate a turnaround plan and judge whether to attempt to rebuild them or withdraw from them

in accordance with the business portfolio basic policy.

By allocating limited management resources effectively, we aim to achieve sustainable improvement in corporate value.

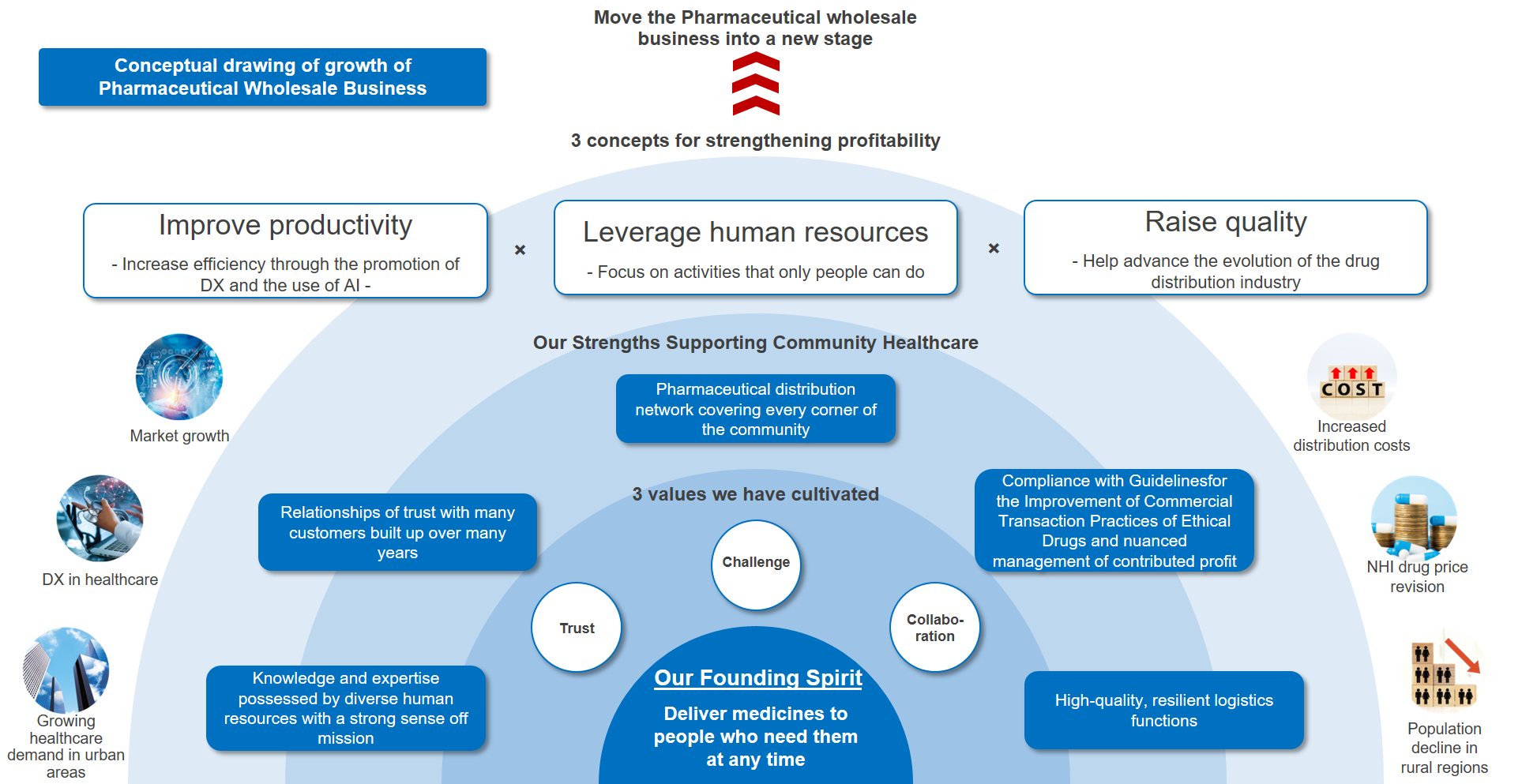

Pharmaceutical Wholesale Business

We aim to further strengthen profitability.

Based on our founding spirit "Deliver medicines to people who need them at any time", we will leverage the values and strengths we have developed to date to grow and advance onto the next stage.

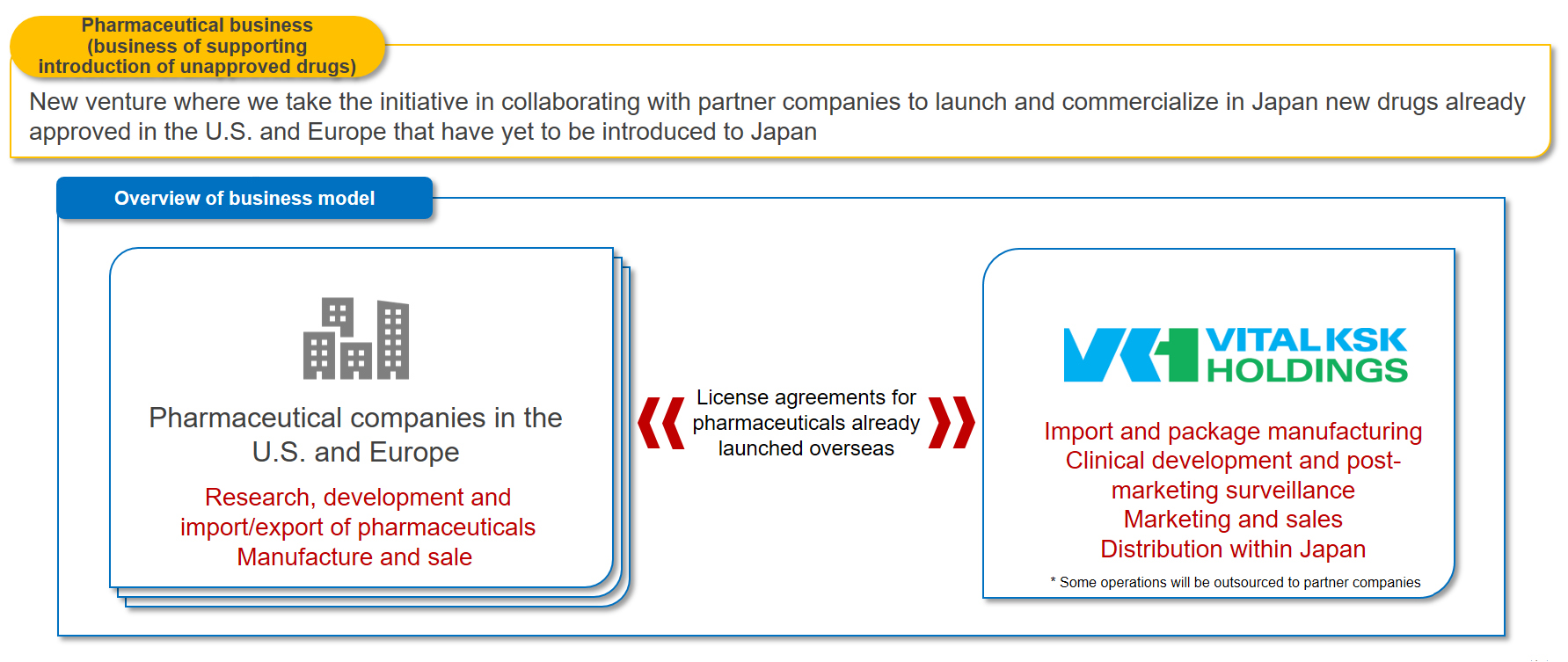

New business

(Logistics services business, Pharmaceutical business (business of supporting introduction of unapproved drugs))

The logistics services business refers to logistics services as a whole including 3PL and transport business.

We will spin off business which previously operated within the Pharmaceutical Wholesale Business to further improve profitability. In addition, we will actively pursue M&A transactions to acquire logistics-related companies.

We have four logistics centers in VITAL-NET, Inc.'s sales area and three in KSK CO., LTD.'s sales area. In FY2026, we will complete a new logistics center as a core facility of the 3PL business in Isehara, Kanagawa Prefecture. Through further development of the advanced and high-quality supply chain we have established to date, we will not simply transport pharmaceuticals but rather turn the logistics function into a new profit pillar.

We have decided to enter this business for the following two reasons. First, to become more proactive about Japan's drug loss and lag issue as a company involved in health care. Second, by getting this business on track, we aim to achieve further improvement in corporate value and fulfil our responsibility as part of the social infrastructure supporting community health care in the medium and long term.

This business is a completely new venture for us. We will also develop this business as a separate business pillar from our core Pharmaceutical Wholesale Business.

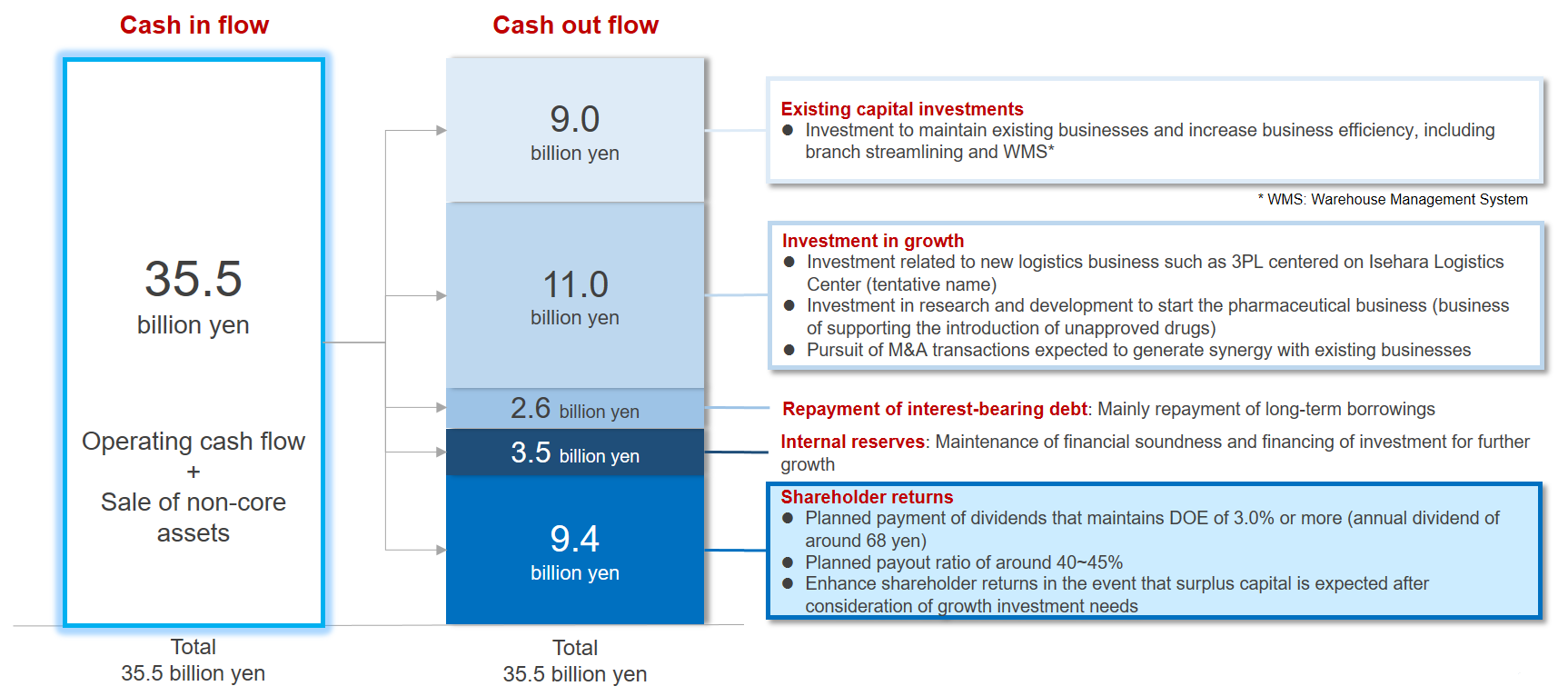

Financial strategy and capital policy

Cash flow allocation

Over the three-year period starting this fiscal year, we plan to generate total cash inflows, including operating cash flow and sales of cross-shareholdings, of ¥35.5 billion. These cash will be allocated appropriately in light of the measures in The Medium-Term Management Plan 2027.

Strengthening of Shareholder Returns

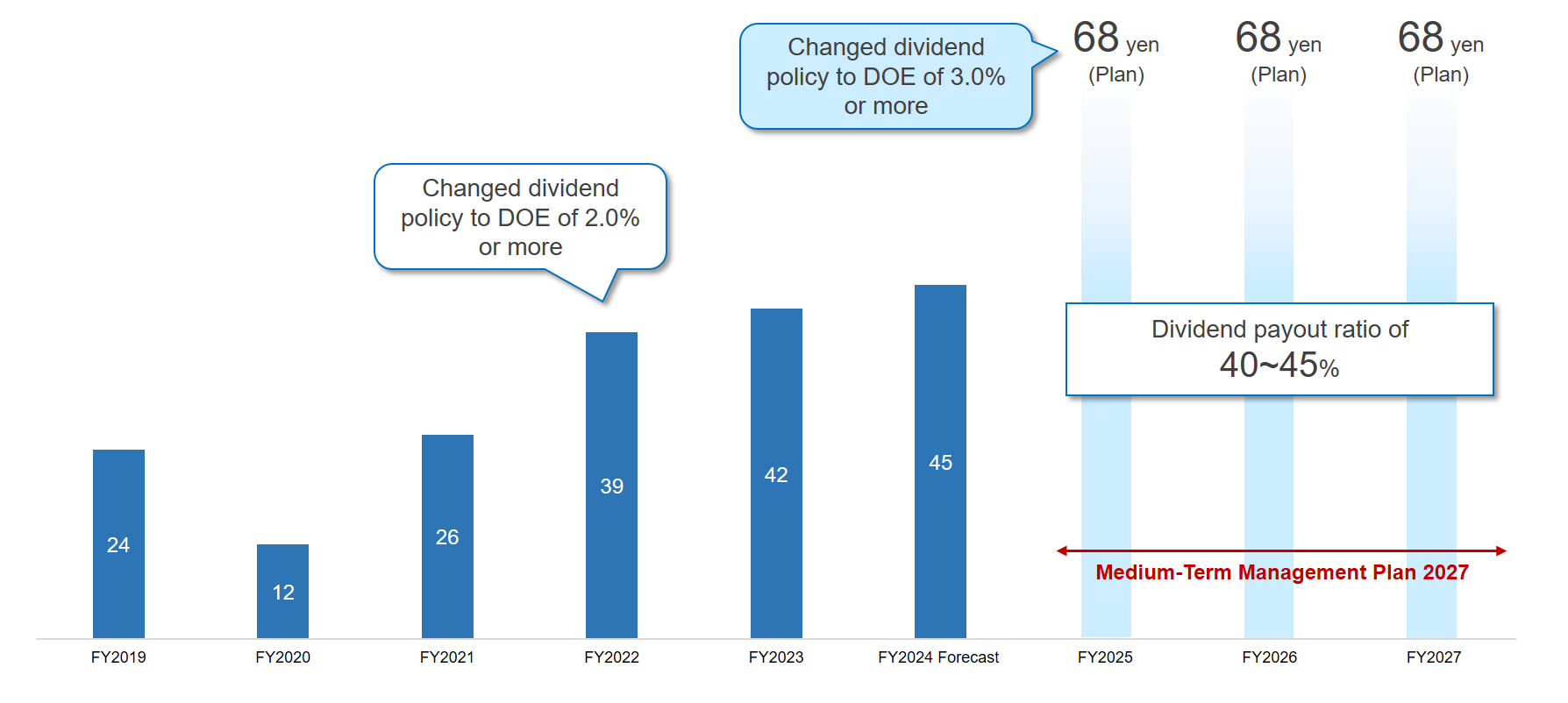

The dividend policy was changed from DOE of 2.0% or more to DOE of 3.0% or more. As a result, the annual dividend will be around 68 yen (planned).

Strengthen group management

Business Portfolio Management Organization

On the finalization of financial results for each fiscal year, the Corporate Planning Department and Accounting & Finance Department will conduct an evaluation of operating companies, in accordance with the Business Portfolio Basic Policy. They will then refer this to the Management Committee and the Board of Directors, in that order, for decisions on appropriate investments and allocations to be made.

Meanwhile, the Investment Committee will consider new business investments and M&A based on rigorous calculation of future profitability, and will refer these to the Management Committee and the Board of Directors, in that order, for decisions to be made.

Additionally, in the areas of sustainability, risk and compliance, we will continue implementing initiatives befitting a company listed on the Prime Market.

We will also continue our ESG activities.

The Medium-Term Management Plan 2027 - Move on to the Next Stage -

* Figures for “FY2024 Forecast” announced on April 17, 2025 have been replaced with actual figures (as of May 14, 2025).