Basic Approach

We believe that corporate governance activities are the foundation for building trusting relationships with our stakeholders.

In addition to raising the awareness of our employees through our corporate philosophy, based on our mission and responsibilities to wider society, we are also working to ensure transparency and soundness of management and speed up our decision-making process, such as through the improvement of auditing functions, and to actively disclose information in an appropriate manner.

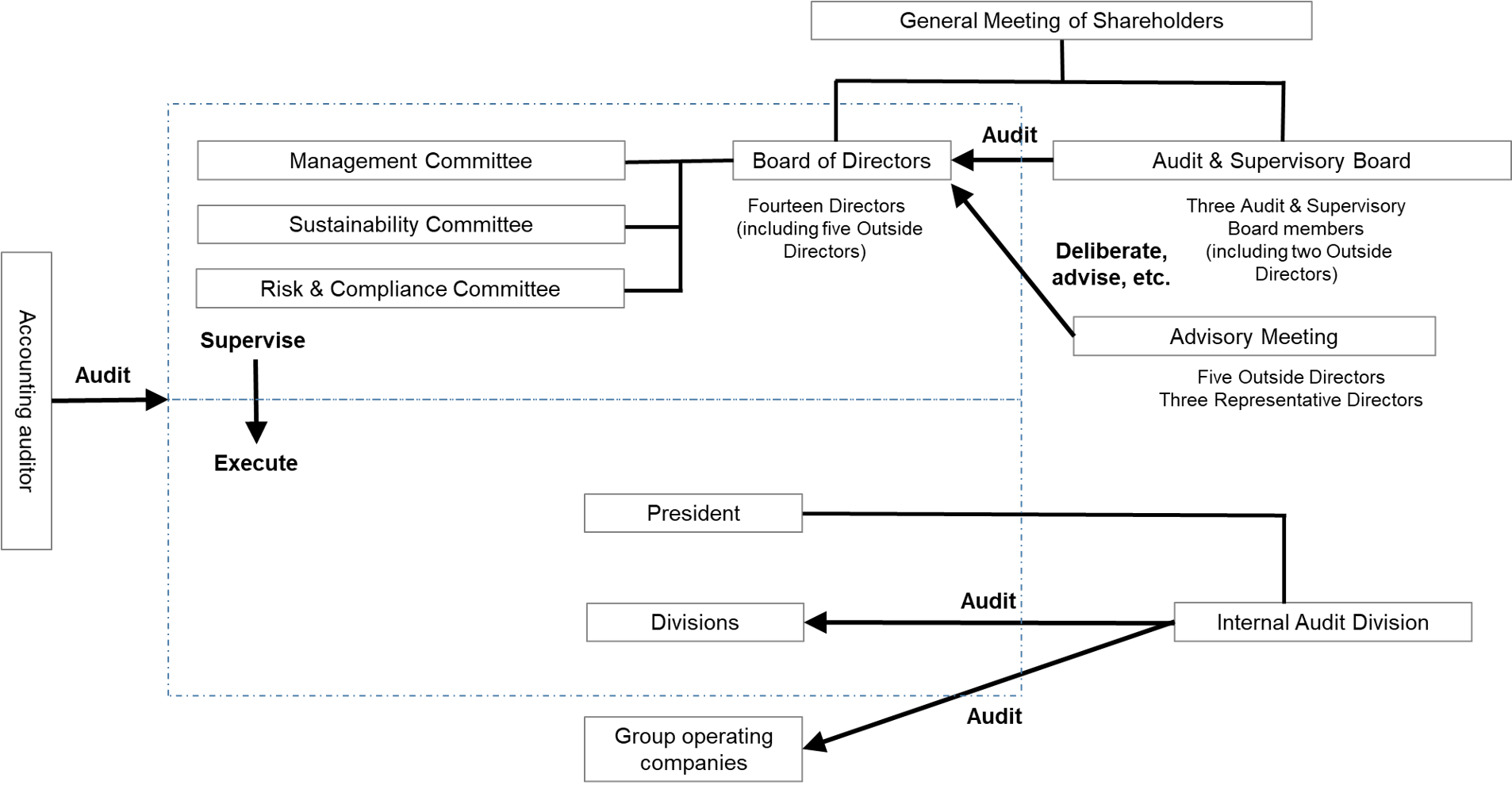

Corporate Governance System

The Company operates as a company with the Audit & Supervisory Committee under the Companies Act.The Board of Directors consists of fourteen members, five of whom are outside directors.These five outside directors have extensive experience and knowledge as a corporate manager, academic expert, lawyer and certified public accountant and provide very significant recommendations and advice for the Company’s management and corporate governance.The Audit & Supervisory Committee consists of three members, two of whom are outside directors (a lawyer and a certified public accountant). By receiving opinions from their respective standpoints, we ensure transparency and soundness of management and have a system enabling them to supervise and monitor the execution of duties by Directors.

Major meeting bodies

| Number of meetings held in FY2022 | Overview | |

|---|---|---|

| Board of Directors | 13 | Resolutions and reports on important matters relating to management |

| Audit & Supervisory Board | 7 | Discussion and resolution of important matters relating to audits |

| Advisory Meeting | 1 | Consideration of the Company's organizational design, evaluation of the effectiveness of the Board of Directors, policies and other matters regarding the appointment and dismissal of directors |

| Risk & Compliance Committee | 2 | Establishment and validation of systems to prevent the occurrence of business / management risks and respond immediately and appropriately when such risks arise |

Company organizations and state of the internal control system

As a general rule, meetings of the Board of Directors are held once a month, and extraordinary meetings are held as necessary to decide upon matters dictated by laws and/or regulations and important matters relating to management, and to supervise the state of execution of business.The Audit & Supervisory Committee meets mainly to verify quarterly and yearly financial results, receive reports from the Internal Audit Division on all aspects of the execution of business, and verify and evaluate that the execution of business throughout the Group is being conducted appropriately and efficiently, based on the annual audit plan.In order to ensure thorough compliance with laws and regulations, the Group has also established a Compliance Statement, as a code of conduct for all officers and employees.

Advisory Meetings

The Company holds regular Advisory Meetings to ensure the transparency and soundness of management.Advisory Meeting membership consists of five outside directors and three representative directors, with the majority comprised of outside members.The meeting works to ensure the transparency and soundness of management by receiving advice from outside members on important management issues relating to corporate governance, such as the nomination and compensation of directors, the evaluation of the effectiveness of the Board of Directors, and the organizational design of the Company, and discussing them.

Main agenda items at Advisory Meetings

- Policy and procedure for appointment and dismissal of directors

- Performance assessment and personnel management for senior management

- Policy and procedure for the remuneration of senior management

- Assessment and analysis of the effectiveness of the Board of Directors

- Policy on corporate governance structure including the Company’s institutional design

Executives’ compensation

The maximum amount of compensation for directors is determined by resolutions of the General Meeting of Shareholders. When determining the amounts of compensation and bonuses, etc., we ensure transparency and objectivity by consideration at Advisory Meetings consisting of five outside directors and three representative directors.The Company has also introduced a Board Benefit Trust (BBT) and Performance-Linked Restricted Stock Compensation System for eligible directors and executive officers, to more clearly link their compensation to the Company’s financial results and stock value and increase their awareness of contributing to better business performance and enhancing corporate value in the medium to long term—by sharing both the benefits of rising stock prices and the risks of falling stock prices.

Approach to cross-shareholdings

The Board of Directors periodically verifies the appropriateness of individual cross-shareholdings. Based on the results, the Company is working to reduce its number of cross-shareholdings.Our method for verifying the appropriateness of shareholdings involves quantitatively verifying returns such as related earnings and dividends received, and the cost of holding shares, etc., in addition to qualitative aspects such as the purpose of the shareholding, for each cross-shareholding.When exercising voting rights, the Company judges whether to approve or disapprove after confirming the rationality of a proposal, such as whether a proposal of the General Meeting of Shareholders hinders the realization of the purpose of a particular shareholding, or hinders business relationships with the Company.

Appointment of outside directors

The Company currently has five outside directors as independent directors, and has established a system to contribute to sustainable growth and the improvement of corporate value over the medium to long term.With regard to independence criteria and qualifications for independent outside directors, candidates for outside directors are selected based on the independence criteria established by the Tokyo Stock Exchange.Moreover, regarding the election of outside directors, the standards for the election of candidates include that a candidate shall have extensive experience in corporate management and broad knowledge and insight, and in particular shall have expert knowledge in laws and regulations, finance and accounting.